How to Establish Amazon Business Accounts in the UK and USA

Amazon has become one of the systems for e-commercial enterprise units in today’s sophisticated digital environment, offering entry to effective tools such as financial institution loans and LTD LLCs to enlarge your e-commercial enterprise on the net. It allows comparable criminal companies to get admission to your e-trade business via Amazon’s adequate gear. If you’re trying to take it to new heights, you need to create an Amazon enterprise account with the help of this tool used to retrieve your task as nicely, creating an Amazon Business account is essential to take your venture further by using its tools. This guide will walk you through making one in both the UK and the USA with helpful insight into setting up bank accounts, creating legal entities such as LTDs/LLCs as well as optimizing accounts in both locations to expand your e-commerce business capabilities further and ensure success when optimizing an Amazon Business account is created successfully.

What Is an Amazon Business Account?

Amazon Business accounts are vital to the business-to-commercial enterprise (B2B) communique. It consists of features that include mass lending, tax-loose advantages, the right of entry to crucial prices for groups, and advanced analytics tools – all on the way to offering a verge of collapse to increase your offerings effectively.

Key Advantages of an Amazon Business Account

- Business Discounts: Get specific wholesale and manufacturing reductions.

- Streamlined purchasing: Combine shopping from a couple of vendors into one centralized network.

- Multi-person debts: Add access for a collection of users with permission topics.

- Tax Benefits: Simplify VAT and sales tax exemptions with our enhanced analytics tools, while tracking and managing spending effectively becomes much simpler.

How to Create an Amazon Business Account in the UK and USA

Step 1: Research and Preparation

Before creating your Amazon Business account, gather the following:

- Email Address: Use a professional email address associated with your business.

- Business Name and Address: Ensure accurate details that match official documents.

- Tax Identification Number (TIN) or VAT Number: Required for tax compliance.

- Bank Account Information: A valid business bank account is required for payments and receipts.

- Legal Company Information: If you operate an LTD in the UK or an LLC in the USA, your company will need registration information..

Step 2: Navigate to the Amazon Business Page

Visit the official Amazon Business page for your country:

- UK: Amazon Business UK

- USA: Amazon Business USA

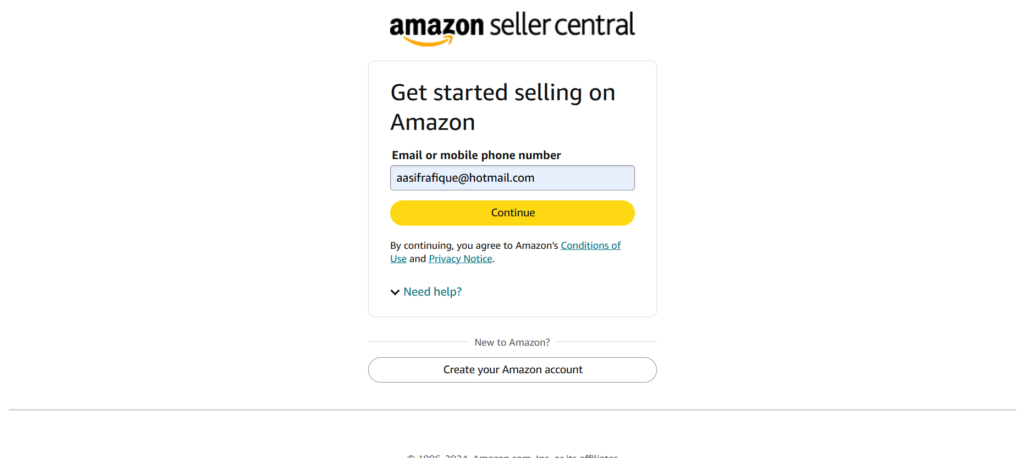

Step 3: Start the Registration Process

- Click “Create a Free Account” on the respective Amazon Business page.

- Enter the following details:

- Your name.

- Professional email address.

- Password for your account.

Step 4: Verify Your Business Information

Amazon will require verification of your business details:

- Business Name: Ensure it matches the name on official documents.

- Address: Include a physical address (P.O. Boxes may not be accepted).

- VAT/TIN Details: Provide accurate tax identification numbers.

Step 5: Add Payment and Bank Account Details

Amazon requires a valid bank account for transactions. Here’s how to set up:

- For UK accounts, ensure the account supports GBP transactions.

- For US accounts, ensure compatibility with USD transactions.

- Amazon uses the bank account for:

- Payments to suppliers.

- Receiving proceeds from sales.

Step 6: Set Up Permissions (Optional)

For businesses with multiple users:

- Add team members with specific roles and permissions.

- Assign roles such as purchaser, admin, or approver.

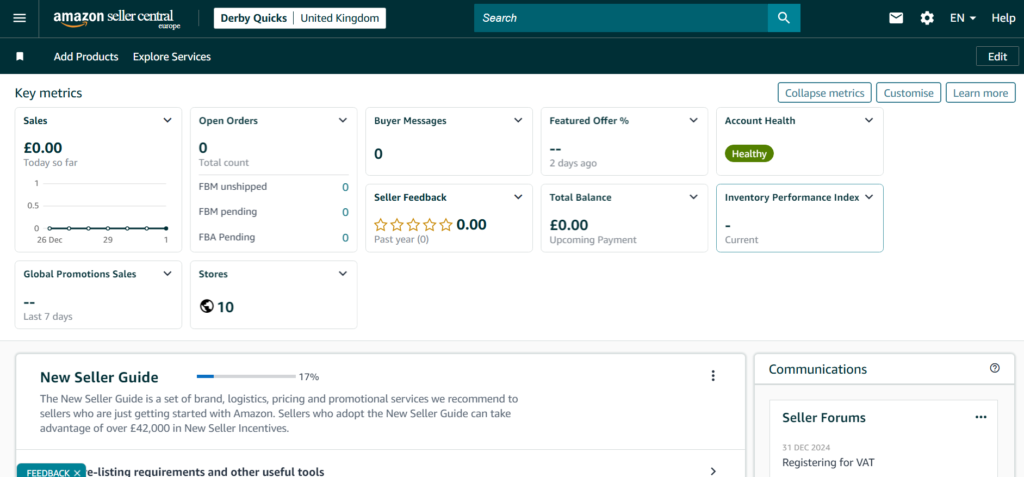

Step 7: Explore Account Features

After setup, take time to explore tools like:

- Order tracking and management.

- Exclusive pricing and bulk purchasing.

- Spending analytics and reports.

Legal Entities in the UK: LTDs and LLCs

LTD (Limited Company) in the UK

- What It Is: An LTD is a type of privately held business structure which limits personal liability in cases of business debts, protecting personal assets from being taken over

- Requirements:

- Registered business name.

- Address for the company (you may use a registered office service).

- Director and shareholder details. Company registration with Companies House.

- Bank Account Setup: Open a business bank account in the name of your company at Barclays, HSBC or Lloyds Bank as some popular choices.

- Amazon Setup:

- When creating an LTD for Amazon account registration, use its details as part of a professional touch.

LLC.(Limited Liability Company) in the USA

- What It Is: An LLC provides limited liability protection while offering tax advantages.

- Requirements:

- Choose an appealing name and register it in your state.

- Submit articles of organization with your state.

- Receive an EIN (Employer Identification Number) from the IRS.

Bank Account Requirements for Amazon Business Accounts

UK Bank Accounts

- Provide proof of your LTD registration.

- Submit personal identification and proof of address.

- Some online banks, like Tide and Revolut, offer quick setup for startups.

USA Bank Accounts

- Use your LLC’s EIN for registration.

- Banks require personal ID, business registration papers, and address proof.

- Consider online options like Mercury or traditional banks like Chase.

Optimizing Your Amazon Business Account Complete Your Profile:

Enter all required information into the profile, such as company logo and detailed descriptions of business operations.

- Enable Tax Exemption Program (ATEP): Take advantage of Amazon’s Tax Exemption Program (ATEP).

- Leverage Analytics: Amazon Business Prime’s reporting tools make it easy to track spending and make optimal purchases.

- Utilize Bulk Discounts:Take advantage of reduced pricing for bulk orders. Engage With Amazon Business Prime: Consider subscribing for extra features such as faster shipping speeds and advanced analytics.

Frequently Asked Questions (FAQs)

1. Can I use a personal bank account for my Amazon Business account?

While you can technically use a personal bank account, it’s highly recommended that you use an agency bank account for operational reliability and ease of bookkeeping.

2. Do I need a VAT number to create an Amazon Business account in the UK?

Yes, tax compliance requires regular VAT adjustments. If your buy is subject to the VAT threshold, seek advice from a tax and business adviser to determine your legal responsibility.

3. Can non-residents create an Amazon Business account in the USA?

Yes, non-citizens can create debts and will still need an EIN, and bank accounts within the U.S. Are likely. To cover the expenses.

4. What’s the difference between Amazon Seller and Amazon Business accounts?

An Amazon seller account is used to promote merchandise on Amazon’s marketplace. Amazon Business money owed is used to buy and manipulate commercial enterprise-related transactions.

5. Is there a fee for an Amazon Business account?

Creating an Amazon Business account is free, but optional Business Prime subscriptions come with additional costs.

Conclusion

Establishing an Amazon Business account in either the UK or USA can be transformative for your company. By understanding its requirements, establishing appropriate legal entities, and optimizing your account to optimize efficiency, you are setting yourself up for long-term success. Whether operating an LTD in the UK or LLC in the USA, following these steps will guarantee an easy setup process enabling you to leverage Amazon’s powerful platform and grow your business effectively.